💡 Revenue vs Profit vs Free Cash Flow – Which One Really Matters?

In One Line: Revenue is vanity | Profit can be misleading | Free cash flow doesn’t lie.

I came across an article that explained this brilliantly (link at the end), and it got me thinking about how we evaluate companies.

We often talk about MRR, ARR, ARPU… but Free Cash Flow (FCF) might be the most revealing metric of all.

Here’s the breakdown 👇

🔹 Revenue – Total money coming in. Big revenue is not a healthy business if costs are just as high.

🔹 Profit – What’s left after expenses. But profit can be influenced by accounting choices, revenue timing, and non-cash items.

🔹 Free Cash Flow – The Real MVP 💰 – Actual cash left after running and growing the business.

Why FCF matters:

✅ Harder to manipulate (cash is either there or it isn’t)

✅ Shows what’s available for dividends, buybacks, debt repayment, and reinvestment

✅ A growing FCF signals a stronger, more resilient company

And the examples make this clear 👇

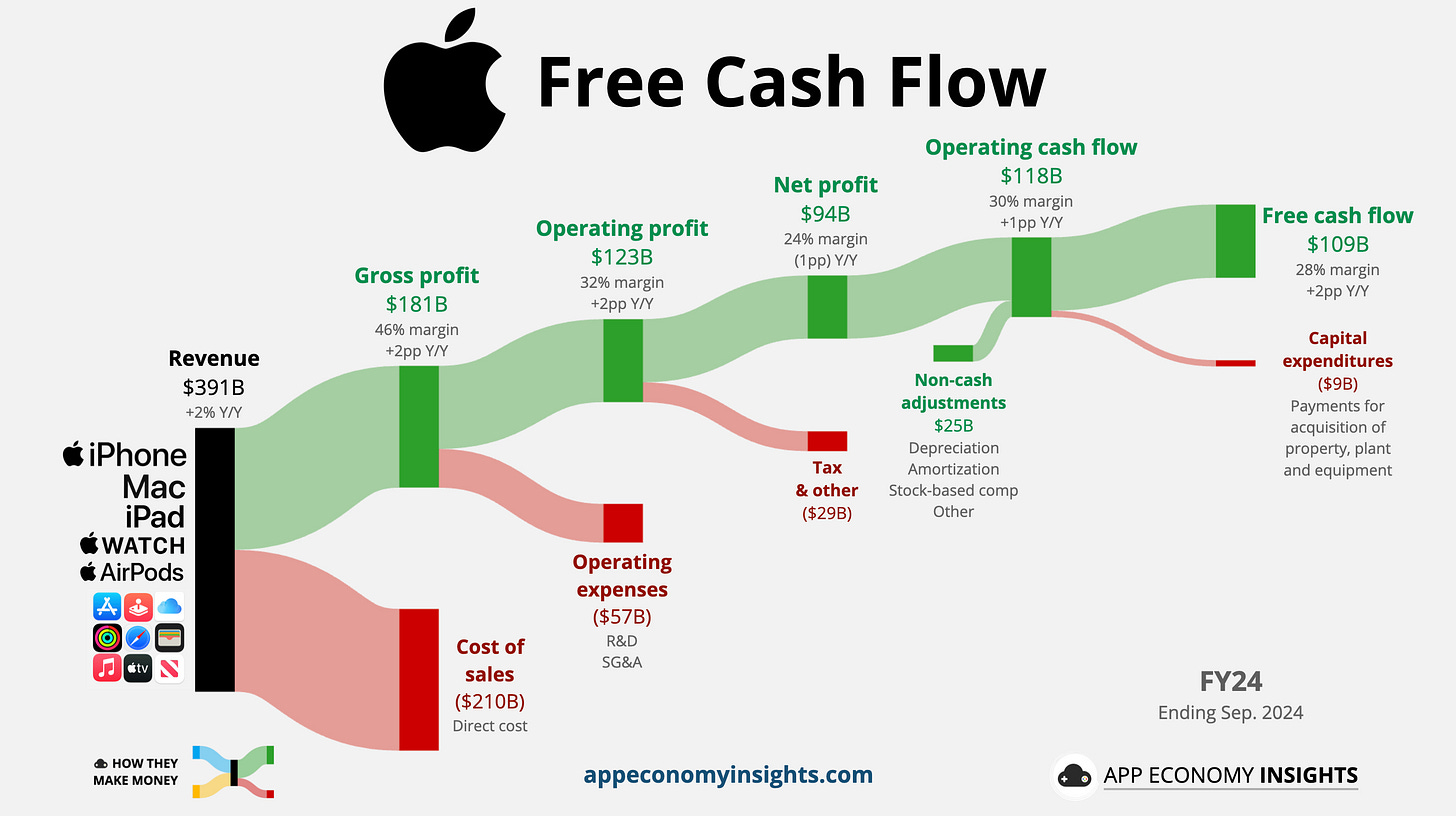

📊 Apple: Consistently prints massive FCF — over $100B a year — funding buybacks, dividends, and innovation all at once.

🎬 Netflix vs Amazon: Netflix had profits but negative FCF for years due to content spend. Amazon’s thin profits hide strong cash generation thanks to AWS and efficient operations.

💡 How You Can Use FCF:

1. Track it over the years - consistent growth is a good sign

2. Compare FCF yield (FCF / Market Cap)

3. Be cautious if profit rises but FCF falls

Think of it like personal finance:

💵 Salary = Revenue

💳 Bills & EMI = Expenses

💰 Savings = Free Cash Flow

That’s why investors like Warren Buffett love businesses with strong FCF — it shows real strength and staying power.

Next time you look at a company, ask: What’s their Free Cash Flow telling me?