💡 How B2B Payments and Supply Chain Finance Are Quietly Powering Global Trade

Digging into how B2B payments and SCF quietly fuel the world’s biggest financial networks.

I was reading Sam Boboev‘s article on B2B payment methods - it’s a simple but insightful breakdown of how businesses move money between each other.

That got me thinking - B2B payments don’t stand alone.

They’re actually the foundation of something bigger: Supply Chain Finance (SCF).

So, I went deeper 👇

1. What are B2B Payments?

When one business pays another for goods or services - that’s a B2B payment.

Unlike consumer payments, these involve larger sums, longer terms, and more friction (invoicing, approvals, FX, reconciliation).

From traditional bank transfers and checks to virtual cards and fintech platforms, B2B payments are going digital, traceable and faster than ever.

2. Why B2B Payments Matter

Efficient B2B payments improve liquidity, reduce risk, and keep the entire supply chain moving.

When payments get delayed, suppliers suffer, production slows, and working capital gets locked up.

In other words, cash flow is the oxygen of B2B relationships.

And that’s where Supply Chain Finance steps in.

3. The Bridge: Supply Chain Finance (SCF)

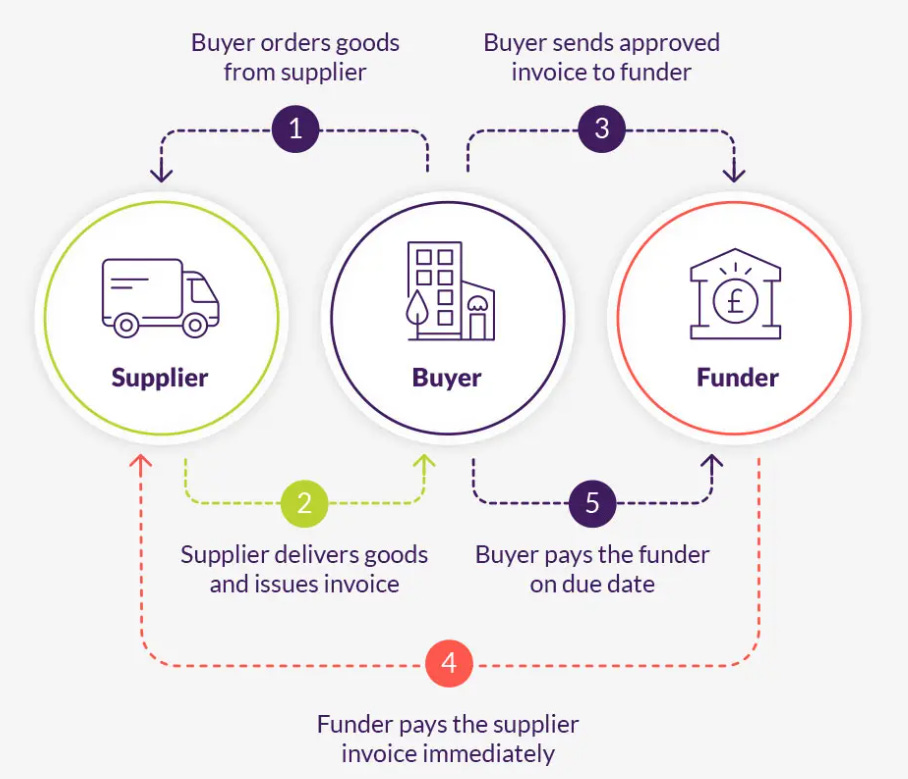

SCF helps suppliers get paid faster without forcing buyers to pay earlier.

How?

A financing partner (typically a bank or fintech) steps in, pays the supplier early, and collects the amount later from the buyer.

It’s a win-win:

Buyers preserve their cash and optimise working capital

Suppliers get immediate liquidity and stay stable

4. How SCF Complements B2B Payments

Think of B2B payments as the rails, and SCF as the train carrying value across those rails.

Without digital, secure, and reliable payment systems, SCF programs can’t operate effectively.

Now, modern platforms are embedding financing within payment flows -Suppliers can opt for early payment → financing happens automatically.

That’s embedded SCF, and it’s where the future lies.

5. The Future: Real-Time and Data-Driven

Over the next 5 years, expect:

- Real-time payments + AI-driven credit models to assess risk instantly

- Fintech and bank partnerships powering embedded finance within ERPs

- Cross-border SCF solutions that eliminate FX friction

Together, B2B + SCF are creating an ecosystem where cash moves smarter, not just faster.

💭 If you’re building or working in payments, it’s worth understanding this bridge between how money moves and how liquidity flows.

That’s where real innovation (and value creation) happens.