💱 Dynamic Currency Conversion (DCC) - What & How 🤔

When you travel abroad and swipe your card, sometimes the POS asks if you’d like to pay in your home currency instead of the local one. That’s what’s called Dynamic Currency Conversion (DCC).

Take an American tourist in Italy, buying shoes for €100.

The system might offer:

Pay €100, and let your bank handle the conversion later.

Or pay ~$120 right away, converted on the spot with DCC fees built in.

For the customer, the benefit is clarity — they immediately know how much they’ll be charged in their own currency.

For merchants and banks, DCC can mean additional revenue from the conversion spread.

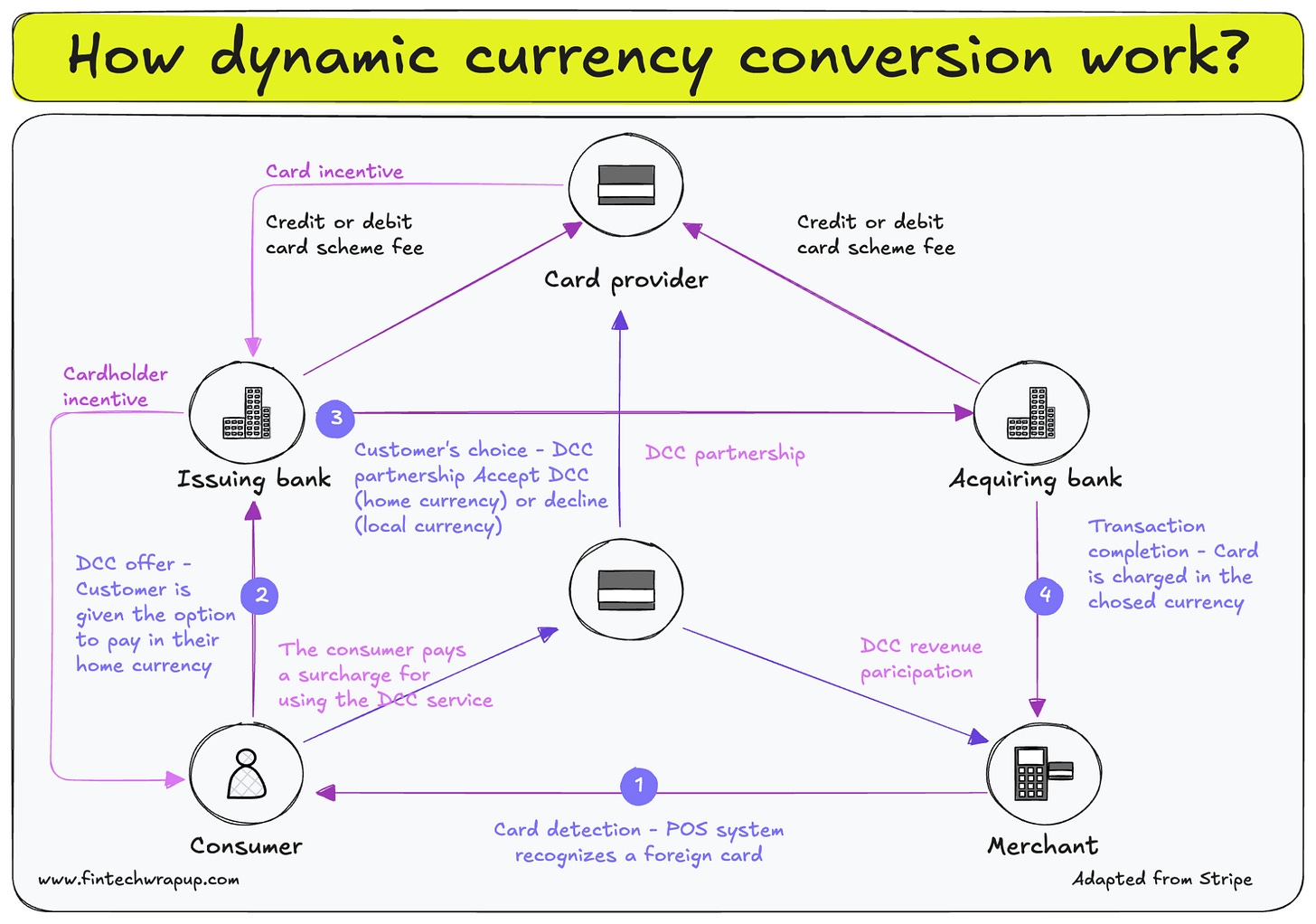

What happens in the background is simple but clever.

1. The POS or online checkout detects that your card is foreign.

2. It then gives you the option to transact in your own currency.

3. If you accept, the transaction doesn’t just flow through the acquiring bank and card network like usual, it goes via a DCC provider, who handles the conversion and ensures your card is billed in your home currency.

For a merchant who wants to offer this, the setup isn’t with Mastercard or Visa directly. You’d typically go through your acquiring bank or payment processor, who can enable DCC on your terminals or e-commerce checkout.

With global travel and cross-border payments growing rapidly, tools like DCC are becoming increasingly relevant — even if customers still debate whether it’s better to accept or decline.

Image From: www.fintechwrapup.com